Commuter Benefits Assistance

Commuter benefits, or transportation fringe benefits, allow employees to use tax-free dollars on transit, vanpool, or qualified parking expenses under Section 132(f) of the IRS tax code. By offering these cost-effective fringe benefits, employers can save money on payroll taxes, attract and retain top talent, and help alleviate parking issues. Arlington Transportation Partners (ATP) offers complimentary assistance to local organizations that want to enhance commuter benefits offered at their workplace. When commuter benefits are successfully implemented, they positively impact both the employer and the employee. ATP can help you choose the best program to meet your business needs and provide on-going support to ensure program success.

Learn more: Perks of the Benefits | Tax Savings | Benefit Options | Employer Services & Support | Resources

The Perks of Commuter Benefits

A successfully implemented commuter benefits program benefits both the employer and employee.

Employers can:

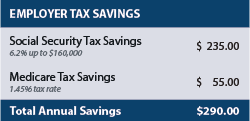

- Save up to 9% on federal payroll taxes

- Reduce parking demand and costs

- Recruit from a wider geographical area

- Enhance employee retention and satisfaction

- Win recognition through Champions, Best Workplaces for Commuters, Bicycle Friendly Business, and more

Employees can:

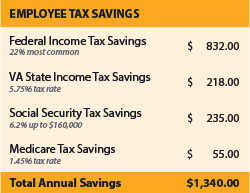

- Reduce taxable income and out-of-pocket commute costs

- Minimize wear and tear on personal vehicle

- Automatically load transit fare on SmarTrip card

- Save time, money, and the environment by riding transit